Bank Co.

Revolutionizing Financial Management for Mid and Large-Sized Enterprises

UX UI Designer

ROLE

2 weeks

PROJECT TIMELINE

Figma

TOOLS

The objective of this project is to develop and implement a cutting-edge banking platform that caters to the diverse needs of our esteemed bank clients. The platform is envisioned to deliver customised solutions, specifically addressing the realms of financial management, transaction processing, and decision support tailored for mid and large-sized enterprises.

PROJECT BRIEF

This project was undertaken as part of a one-week Request for Proposal (RFP) process.

PROBLEM STATEMENT

How might we develop and implement a cutting-edge banking platform that addresses the diverse and dynamic needs of mid and large-sized enterprises, considering the limitations of traditional banking platforms in customization and agility, to provide comprehensive financial management capabilities, streamlined transaction processing, and insightful decision support tools within the constraints of a one-week Request for Proposal (RFP) process?

RESEARCH

Brand Study

Our design journey commenced with a project plan review and product familiarization meeting. Given the brief nature of this pitch project and the time constraints limiting a comprehensive user study, we initiated the process with personal observations and insights gathered from the client. In the face of copious information, I engaged in a clarifying dialogue with the client to discern and align their platform goals.

Competitors Study

To commence a thorough exploration of industry practices, the project initiated with a meticulous examination of various platforms. This phase aimed to deeply understand the prevailing design implementations and solution strategies within the sector. After individually scrutinizing and analyzing competitor platforms, a synthesis of crucial information and key insights was compiled and organized within a structured framework. This strategic consolidation facilitated a clearer understanding of the differences between platforms.

DEFINE

SWOT Analysis

Following an in-depth examination of competitors, we translated our findings into actionable insights through the execution of a SWOT analysis. This analytical approach enabled a pragmatic, evidence-based, and data-informed assessment of the organization's strengths and weaknesses, both internally and within its industry. Maintaining the accuracy of the analysis requires steering clear of pre-existing assumptions or ambiguous areas, with a concentration on real-world contexts. It is advisable for companies to consider the SWOT analysis as a guiding framework rather than a rigid prescription.

Innovative Features: The platform aims to incorporate cutting-edge features, such as advanced analytics, AI-driven insights, and real-time market updates, providing a competitive advantage.

Collaboration Tools: Emphasis on collaboration features enhances communication and interaction among corporate clients, fostering a collaborative financial environment.

Tailored Solutions: The focus on providing tailored solutions for financial management, transaction processing, and decision support caters specifically to the diverse needs of mid and large-sized companies, ensuring client satisfaction

Global Connectivity: With a focus on scalability and global connectivity, the platform is designed to meet the needs of large enterprises with multinational operations.

Strengths

Learning Curve: The integration of innovative features may result in a steeper learning curve for users, potentially impacting the ease of adoption.

Initial Complexity: The initial complexity of the platform might require users to invest time in onboarding and training programs, potentially delaying the realization of benefits.

Integration Challenges: Depending on the platform's compatibility, there might be challenges in integrating with existing third-party tools, posing a potential barrier for some users.

Limited Accessibility for Small Companies: The platform's focus on mid and large-sized companies might limit accessibility for smaller enterprises with more constrained resources.

Weakness

Market Differentiation: The emphasis on tailored solutions and advanced features presents an opportunity to differentiate the platform in a competitive market.

Mobile Optimization: Addressing mobile accessibility and optimizing performance for on-the-go users can tap into the growing demand for mobile financial management.

Cost-Effective Solutions: Exploring competitive pricing models could open the door to a broader market, attracting mid-sized companies seeking cost-effective solutions.

Customer Support Enhancement: Strengthening customer support services can address user queries promptly, improving overall user satisfaction.

Opportunities

Competitive Landscape: The banking technology sector is highly competitive, and the platform faces the threat of losing market share to established competitors with loyal user bases.

Data Security Concerns: The increasing frequency of cyber threats and data breaches poses a threat to the platform's reputation if not addressed with robust security measures.

Rapid Technological Changes: Rapid advancements in technology may pose a threat, as the platform needs to stay current to maintain its cutting-edge status.

Regulatory Changes: Changes in financial regulations could impact the platform's compliance requirements, requiring continuous adaptation to stay within legal boundaries.

Threats

User Persona

After consolidating and analyzing research data, we developed 4 personas. These personas serve as constant reminders for both us and the client about the individuals we are designing for, their needs, wants, and pain points.

-

Julie Sanders - CFO, Midwest Apparel

-

Alex Connors - Treasurer, Midwest Apparel

-

Glenn Andrews - Manger, Telex

-

Claire Smith - Initiator, Midwest Apparel

IDEATE

Information Architecture

We meticulously crafted an information architecture to optimize navigation and enhance user experience. By strategically organizing and structuring information, we aimed to simplify the user journey, ensuring that users can easily locate and access the features and functionalities they need.

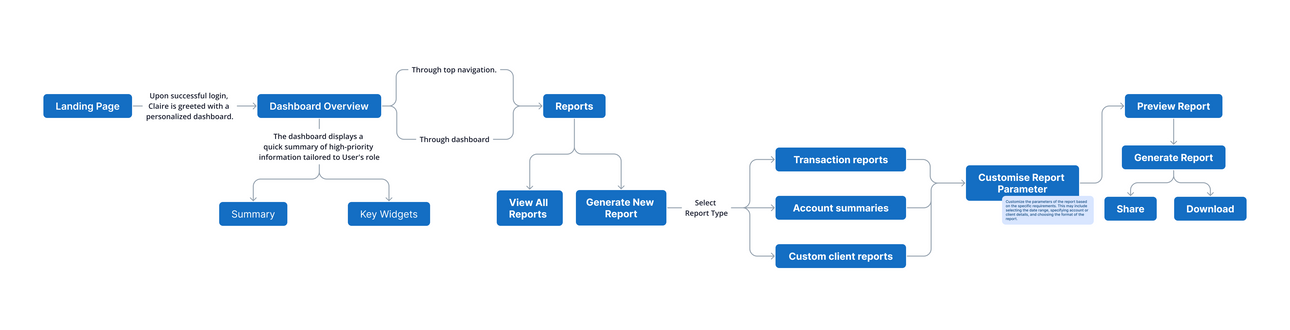

User Flow

Leveraging on our research on customers' needs, wants and expectations, as well as market trends, competitor analysis and emerging technologies - the User flows were created to understand the user naviigation patterns

Low Fidelity Wireframes

-

The tool I used for this is Figma

-

We made low-fidelity wireframes

-

The wireframes helped us test the eye movement, visual hierarchy and overall layout.

Application Review

Onboarding

Reporting Home

Add New User

Dashboard Approver

Dashboard - Processor

DESIGN

High Fidelity Screens

Recognizing the interface's pivotal role in crucial decision-making tasks like payment approval, report generation, and bill payments, I embraced a clean and modern design style.

Addressing the challenge of handling real-time, dynamic data—updating nearly every second—brought an intriguing dimension to the design process.

Viewports

The designs were meticulously crafted for seamless accessibility across different devices, ensuring users could engage effortlessly. This approach prioritized responsiveness, enabling access to critical functionalities and data regardless of device, enhancing usability.

By prioritizing adaptability, the design accommodated diverse user preferences, resulting in an optimized and consistent user experience across various screen sizes and resolutions.

Learnings & Experience

Learnings

-

User-Centric Approach: Prioritizing user needs and workflows ensured the design resonated with the diverse requirements of mid and large-sized enterprises.

-

Simplified Navigation: Streamlining navigation pathways facilitated easier access to key features like financial management tools and transaction processing functionalities.

-

Visual Hierarchy: Establishing a clear visual hierarchy helped emphasize important information and actions, enhancing usability and efficiency.

-

Customization Options: Providing customizable features allowed users to tailor the platform to their specific preferences, enhancing overall user satisfaction.

-

Consistent Design Language: Maintaining consistency in design elements and patterns across screens ensured a cohesive and intuitive user experience.

-

Iterative Design Process: Embracing an iterative design process allowed for continuous refinement based on user feedback, resulting in a more polished and user-friendly final product.

-

Accessibility Considerations: Integrating accessibility features ensured the platform could accommodate users with diverse needs and abilities, promoting inclusivity.

-

Collaborative Design: Collaborating closely with stakeholders and cross-functional teams facilitated alignment and informed design decisions, ultimately leading to a more effective solution.